Securing Wealth with Gold Investment

At The Four Nines, we specialize in providing tailored solutions for gold investment, banking, and consultancy services to banks, hedge funds, and private investors. With our expertise, we're here to help you navigate the world of gold with confidence.

Gold Investment Services

We offer customized gold investment options that align with your financial goals, ensuring your wealth is preserved.

My personal experience working through various bank crashes over the years I have always maintained and purchased tax free pure investment gold for security.

Gold Banking

Discover a unique gold banking system designed to offer both security and accessibility for your investments. Our innovative approach transcends traditional banking rules and regulations.

The gold you store in our secure vaults serves as collateral for your spending through our gold debit card. You can purchase gold from us at the current daily price (LME).

As you make purchases, we liquidate the corresponding amount of your gold based on the LME holding to cover your expenses. Please note that the value of the physical gold in your account may fluctuate in accordance with the LME price.

Experience a revolutionary way to manage your wealth with our gold banking system.

Consultation and Advice

Our gold experts are here to guide you through every step of your investment journey with professional insights.Over 45 years in the physical gold industry with the world data at our finger tips.

We are in an unpressidented banking period with many issues.

For straight talking please make contact.

Leading Gold Dealers

Experience and Expertise at Your Service

We are mandates Au/gold sellers in large quantities supplying banks, hedge funds, and private investors.

Our experience in building a physical gold bank is complemented by 45 years of expertise per person.

Trust us to guide you through your gold investment journey.

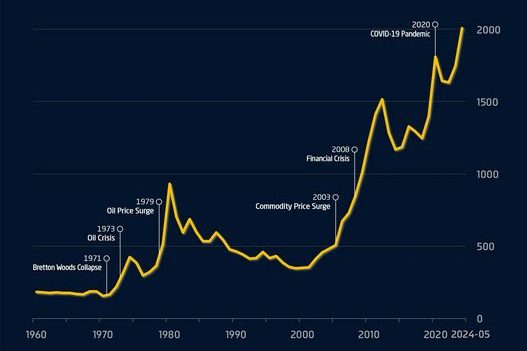

Market Overview Monday 9th December — Friday 13th December

Gold and Oil Analysis US Interest Rates Gold hit its highest since 6th Nov on Thursday but succumbed to profit-taking on Friday as the market looks to this week’s US rate decision.

Traders now see a 96% chance of a 25 basis point rate cut at the Fed's meeting.

The European Central Bank cut interest rates last week and kept the door open to further easing in 2025 in the face of a struggling economy and heightened political risks.

Investors even see a 30% probability that the January cut will be 50 basis points, or that the rate-

cutting streak will last beyond June, taking the deposit rate to 1.75% by end-2025.

The Swiss franc weakened after the Swiss National Bank cut rates by half a point, its largest reduction in nearly 10 years. Markets had priced a good chance of a half- point cut in the run-up to Thursday's meeting.

The US Labor Department's producer price index, which tracks the prices US companies get for their goods and services at the figurative factory door, jumped by 0.4%, leap-frogging over the 0.2% con-sensus and marking an acceleration from October's upwardly revised 0.3% gain.

Wednesday's inflation reading showed the consumer price index rose exactly in line with expectations in November.

The market has essentially seen one of the last remaining obstacles that could derail sentiment out of the way.

©Copyright. All rights reserved. The Four Nines Investment Company Ltd, UK

We need your consent to load the translations

We use a third-party service to translate the website content that may collect data about your activity. Please review the details in the privacy policy and accept the service to view the translations.